Ever since I quit my job to become a Solopreneur, I knew I had to keep better track of my finances.

To keep myself accountable I started a newsletter (called the Early Exit Club) where I transparently share my monthly finances to all 578 of my subscribers (as of writing).

And to do that I use Tiller Money.

What Is Tiller Money?

Tiller is complete personal finance service that permanently lives inside your spreadsheets.

It connects to your banks and credit cards (and doesn’t store any of your personal information) and passes it directly to Google Sheets or Microsoft Excel.

Think of it like a tunnel, but for your finances.

Tiller never sees your actual financial data.

Here’s why that is really cool 👇

Unlike other personal finance tools, Tiller gives you the raw data to manipulate as you see fit.

If you’re a spreadsheet pro you can go HAM on this stuff.

And if you’re not? It’s all good, Tiller’s got you with some killer templates that you don’t need to tweak at all.

And all that for less than the price of your oat milk latte every month is a pretty sweet deal.

Let’s get into my full review of Tiller.

Tiller Money Review

Tiller is an extension for Google Sheets and Microsoft Excel that you can access anywhere.

It permanently lives under Extensions in all your Google sheets which is how I use it.

It comes with a free 30 day trial (which you can start right here!).

Using Tiller is easy:

- Connect your bank accounts and credit cards

- Link Tiller to Google Sheets or Excel

- Import all your transactions

You’ll need to input your login info for each account (Tiller uses Yodlee to connect to and from your accounts so they never actually see any of your personal financial data).

From there you need to get setup

- Customize your spreadsheets

- Review your balances

- Edit your categories (we’ll get to this!)

- Customize your template

The Tiller Foundation Template

After signing up for your free 30 day trial, here’s what to do in your first 30 days.

Everyone starts with what Tiller calls the foundation template.

It’s what all of Tiller’s additional features and community templates are built on (hence, the foundation).

The main sheet looks like this.

The foundation sheet has tabs for:

- Insights

- Transactions

- Auto categorization

- Categories

- Monthly Budget

- Yearly Budget

I’ll cover each of them including how I use them.

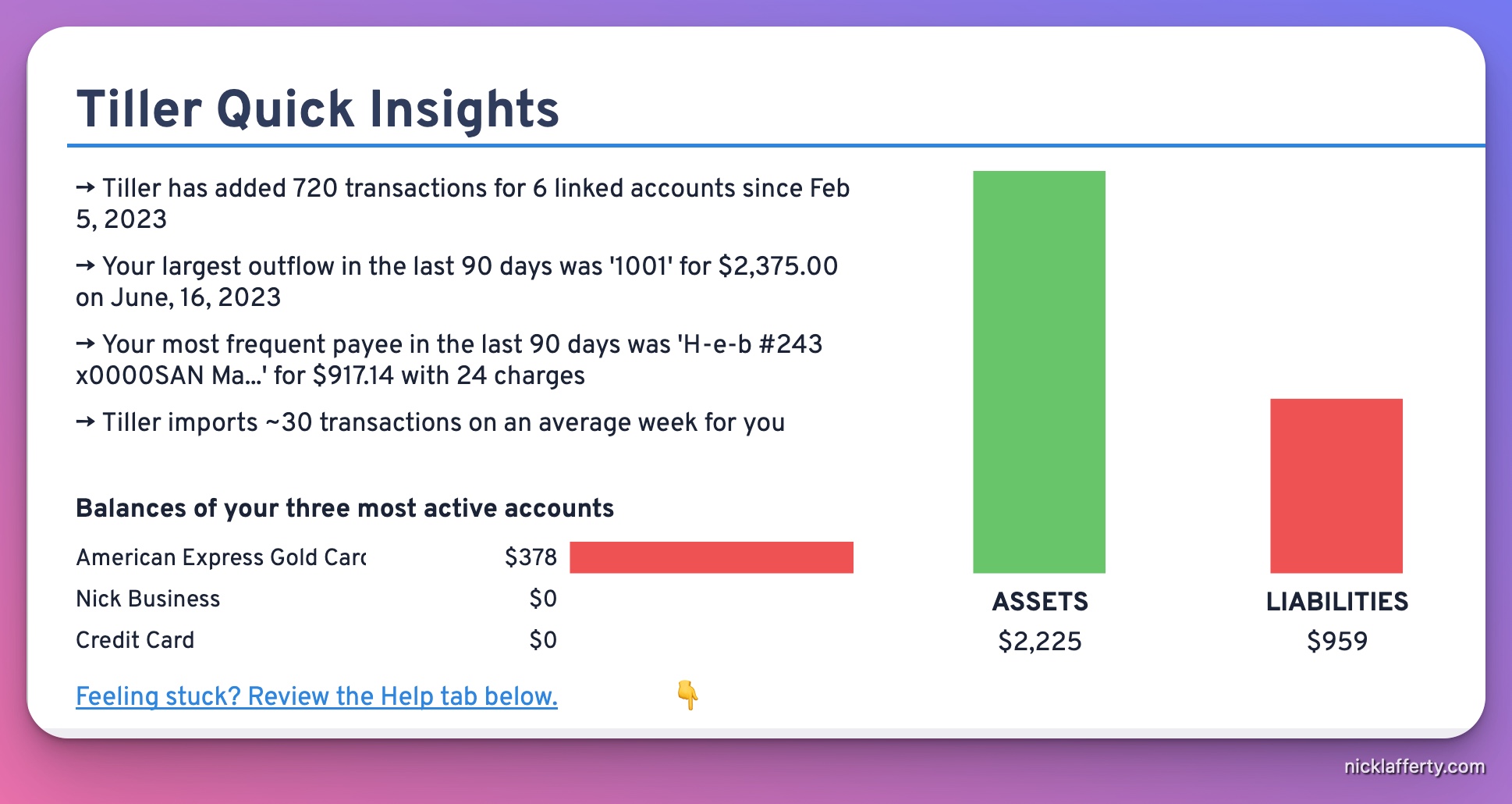

Tiller Insights Tab

It shows quick insights like:

- The number of transactions and linked accounts since you signed up

- Your largest purchase in the last 90 days

- Your most frequent payee

- The average number of transactions per week that Tiller imports

I don’t personally use the Insights sheet that much.

I mainly stick to the Transactions, Categories, and Monthly Tracker.

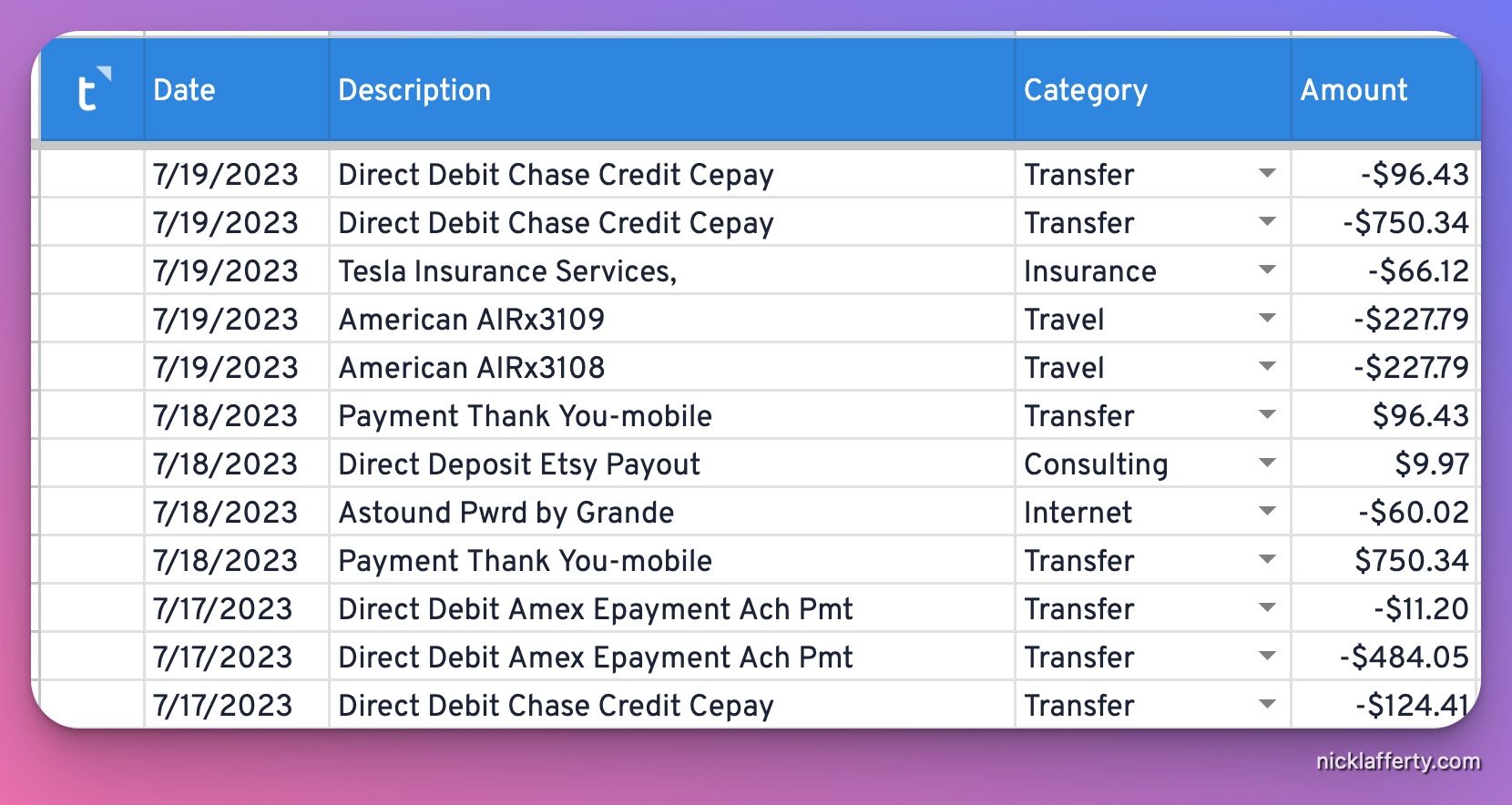

Transactions Tab

The transactions tab, pictured above, is an organized list of your most recent transations.

It has:

- The date

- Description

- Category

- Amount

- Account name

- Account number

This is where using Tiller begins.

Every Monday I open this spreadsheet up to review and categorize my transactions.

If I went to a new restaurant over the weekend then I need to categorize that purchase.

But you probably have recurring transactions too:

- Your rent or mortgage

- utility payments

- Recurring subscriptions

What do you do with those?

Surely categorizing them every single time gets really repetitive.

Enter AutoCat

Autocat is a way to automatically categorize transactions based on the text in the description field.

Your mortgage or rent payment probably looks the same every month.

Same with your other recurring bills.

You can enter that into AutoCat and tell Tiller what category to put the transaction under.

Then when Tiller imports your transactions it’ll auto categorize (AutoCat!) the transactions.

Every Monday I also review if I need to add more lines to the AutoCat doc.

You can also auto categorize by:

- The amount (contains, minimum, or maximum values)

- The institution (what bank processed your payment)

It’s a super handy way to not spend a ton of time categorizing your transactions every week.

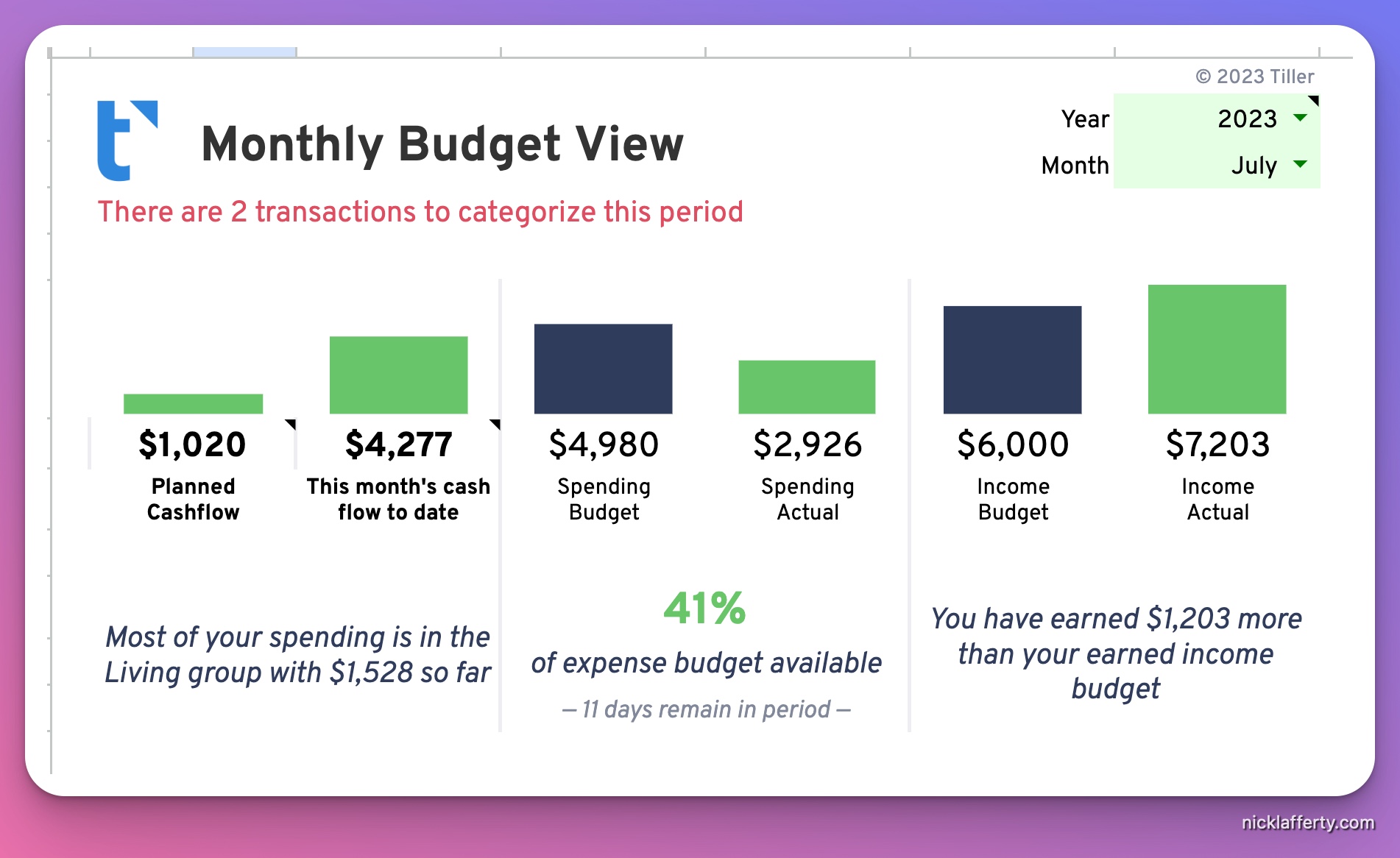

Tiller Monthly Review

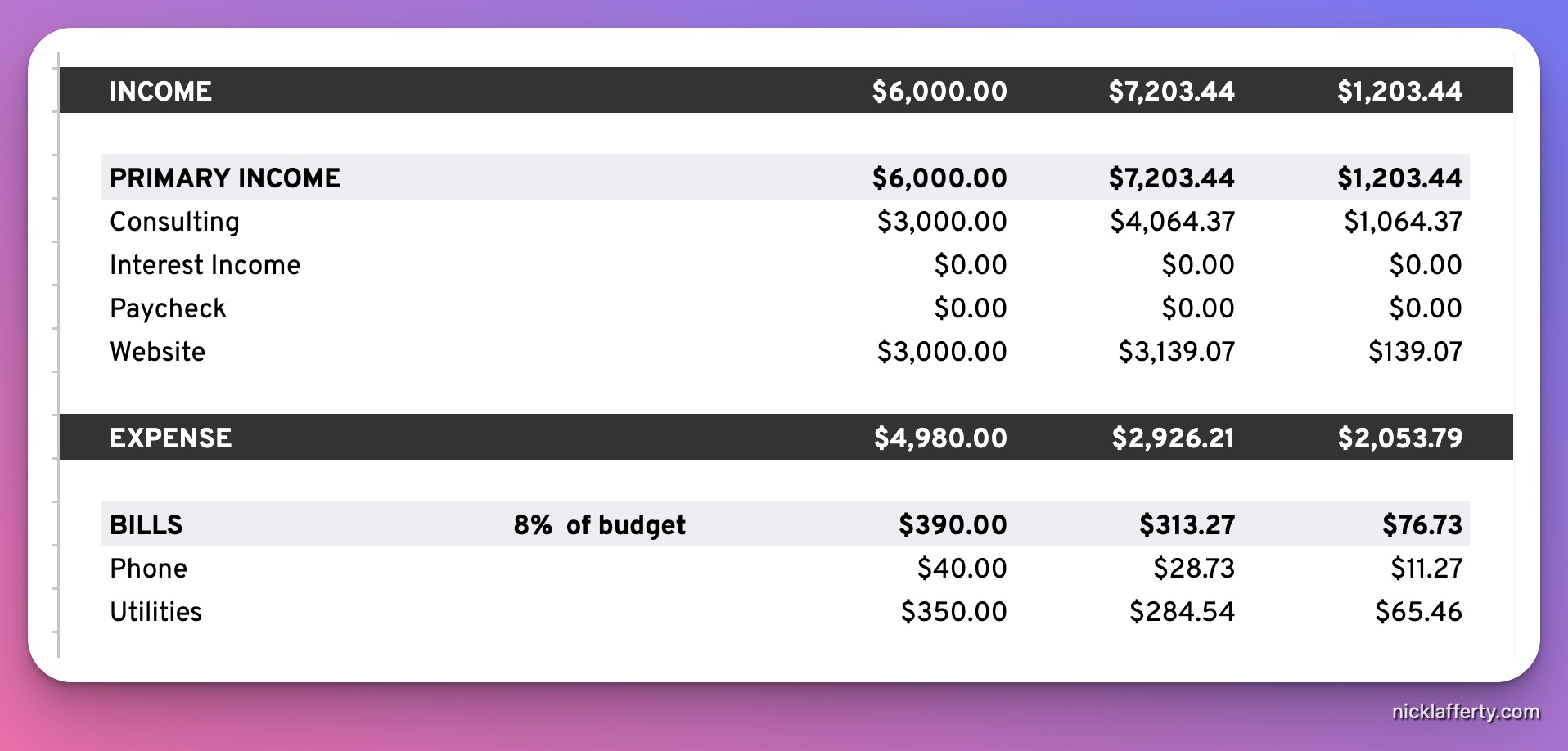

I spend the most time analyzing my personal finance data in Tiller’s monthly view.

It’s a monthly rollup of your data by category:

- Income

- Expenses

- Discretionary spending

- Living

You can define and change those categories as you see fit, too.

Tiller will tell you what % of your budget is spent on each category, the total amount, and how much you spent according to the budget you defined on the categories page.

It’s a great way to see if you’re on track or if you bought way too much shit on Amazon this month.

I’d recommend setting up categories for your common purchases.

The ones I added include:

- Costco

- Amazon

- Video games

- Coffee

- Avocado Toast (just kidding..)

This is the magic of Tiller.

You can set it up exactly how you want!

Need a new category? Add it to the Categories sheet in 5 seconds.

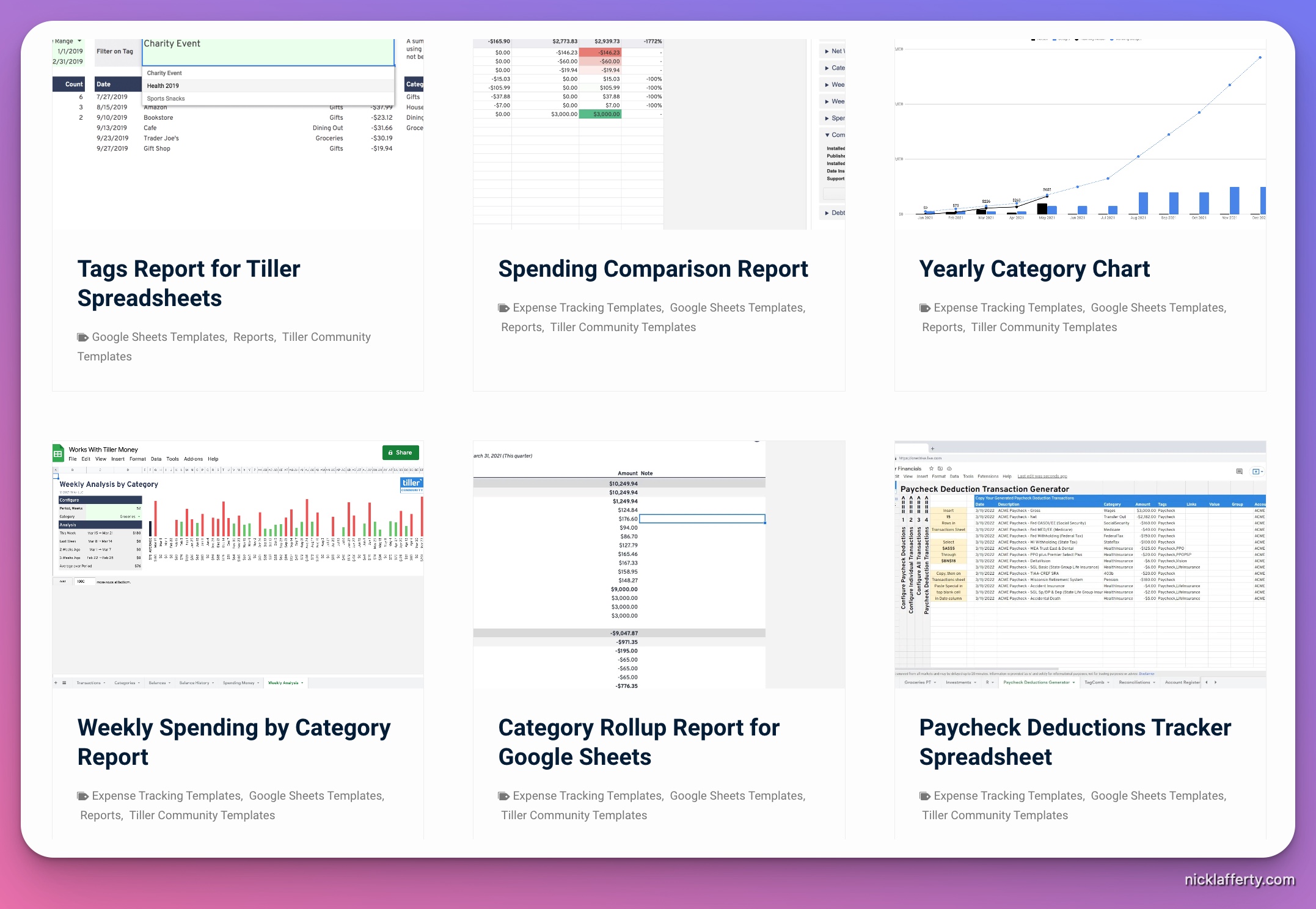

Free Community Solutions & Templates

Tiller comes with some great pre-made templates but you also get access to 60+ community made solutions and templates too.

Templates are just other pre-made Google Sheets that add additional ways to slice your data.

But solutions are actual add-ons to the Tiller product that give you more functionality to the tool.

There are community templates and solutions for:

- Yearly category reviews

- Paycheck deductions tracker

- Cash flow forecast

- Recurring expenses

- Adding a tags column for better organization

And a ton more.

Frequent Questions

How Much Does Tiller Cost?

Tiller costs $79/year which is less than $7 a month.

For less than the cost of an oat milk latte you can get a better view of your financial picture.

Tiller vs YNAB

How does Tiller compare to YNAB? It’s cheaper and more flexible, but YNAB has a much nicer interface.

After all, Tiller is just a spreadsheet. YNAB is a full system that costs $14.99/month (or $99/year).

YNAB isn’t much more expensive than Tiller, but you have to really buy into the YNAB system of planning all your expenses a month in advance.

I’ve tried to use YNAB twice and it never stuck. But some people swear by it, so your mileage may vary

Is It Safe And Secure?

Yes, Tiller never stores or sees any of your data.

Tiller does not make money selling your data or by showing ads.

Your data is securely processed via Yodlee which is regularly audited by banks and regulators.

Tiller does not see or store your bank credentials. They can’t see any of your private transaction data.

Summary

Tiller is a great way of tracking your full financial health.

And what gets tracked gets improved.

Within a month of using Tiller I saw that I was spending way too much on Amazon so it was easy to purposefully cut back.

I’ve more than made up for the cost of Tiller with the savings I’ve found with my bullshit purchases.

And if you’re thinking about leaving a job (or if you get laid off), then Tiller can really help you out.